View my LinkedIn profile and learn more about my network.

https://www.linkedin.com/in/vickypeterson/

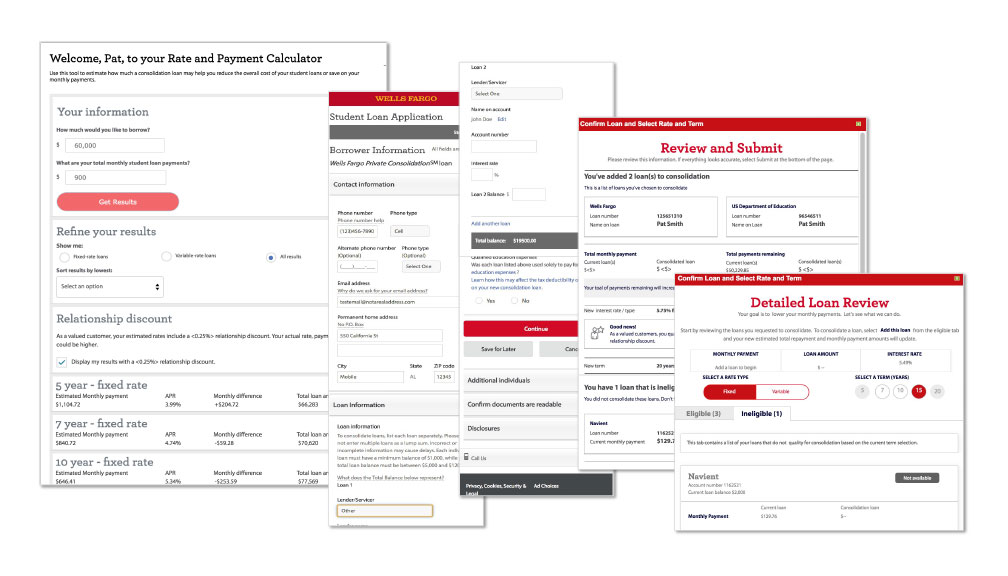

Student Loan Consolidation

UX Product Design Lead

What I did:

- As project lead, directed the design, maintained momentum and kept the communication lines open for this fast tracked project requiring 2 DXD teams, across multiple platforms

- Managed the big picture design vision of a very complex project that consists of over 9 feature sets that were all interrelated

- Designed and created a new flexible loan calculator on one platform with the goal of expanding to multi product and multi user applications, while simultaneously directing other designers, providing subject matter expertise and guidance for all the other portions of the project

- Presented those experience strategies as wireframes and user flow visuals for partner discussions and to clearly direct the rest of the design team deliverables

- Created a highly functional, 4 platform prototype of the end-to-end experience for usability testing

- Worked with design team, business and research partners to guide the usability tests and assess the outcomes to better improve the product direction and customer experience

Because there were new rules around consolidating federal student loans, Wells Fargo was able to offer a consolidation product that included these loans. This business opportunity allowed Wells Fargo to be able to give better product options to more of their private consolidation customers.

- Multiple technologies and platforms needed to be updated and modified

- Previous process required customer to apply 1st before they knew what loan options they could have or if they qualified

- Any existing loan tools were generic and not very customer centric

This suite of new tools and updates broadened the customer options by allowing them to include federal student loans in their WF consolidation loan

- Improve the end-to-end customer experience

- Answer top-of-mind questions early: Add rate checking tools – anonymous and soft-credit pull

- Make it easy on the customer by Pre-filling and simplifying the application based on rate checking tools, internal data, online banking credentials

- Build new “tangible benefits” tool in loan fulfillment platform - Compares the rate, payment and total cost of the consolidation loan, to the existing loan(s)

The project delivered a valuable digital shopping experience from the customer’s research to application submission activities and created valuable new tools that can be utilized across platforms and can be adopted for any product.

By creating tools that assisted our customers in understanding a very complex process, it:

- Increased engagement by allowing them to be confident and make informed loan decisions

- It put the loan information before the application and hard credit checks, boosting application starts and potentially getting more loans processed