View my LinkedIn profile and learn more about my network.

https://www.linkedin.com/in/vickypeterson/

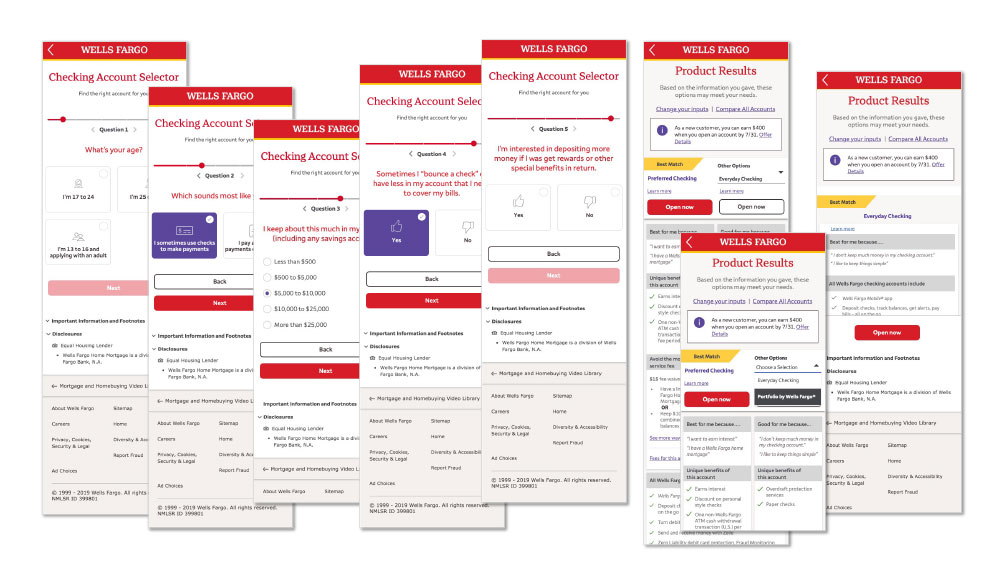

Product Selector

UX Product Design Lead

What I did:

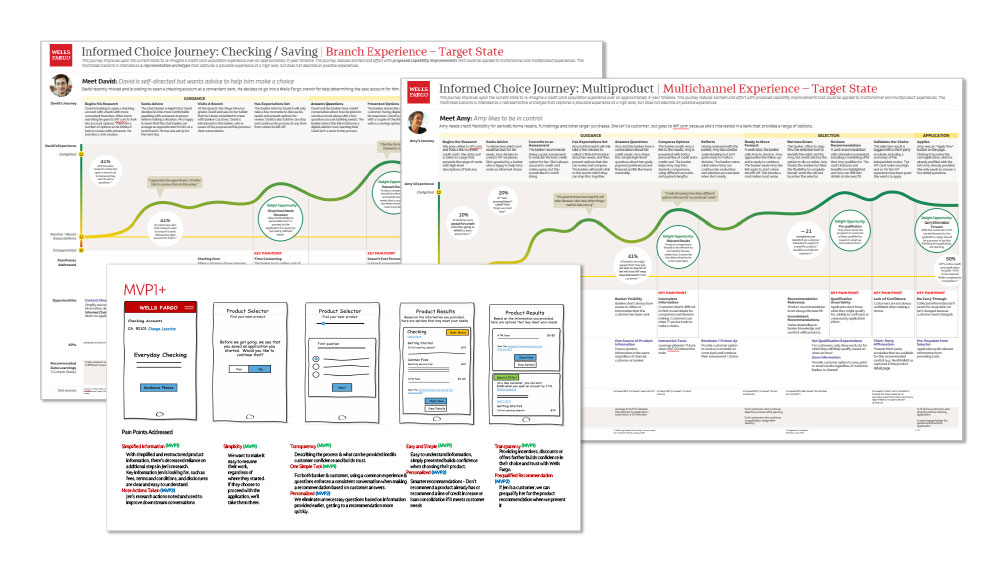

- Leveraged knowledge learned from previous discovery design initiatives (that I was part of) and strategy for Consumer Deposits customers and bankers along with findings from customer and banker user research to design a simple product comparison and selection tool

- Worked directly with product partner developing epics, features and strategies to effectively connecting user needs with business goals throughout all the planned MVPs

- Presented those experience strategies as wireframes and user flow visuals for partner discussions and to clearly direct the rest of the design team deliverables

- Lead design team on parallel tracks, quickly creating required designs, strategies and deliverables for the immediate MVP0 scrum requirements, along with producing design concepts and initiatives for the future 1-5 year visions, incorporating the NorthStar discovery ideas and user testing findings

- Created prototypes and managed user testing direction, timing and feedback ensuring it was effectively incorporated into the designs and future work

- Initiated the journey mapping process to better frame how our customer travels through the process to better define our future design direction

This a Consumer Checking product recommendation engine that guides customers and bankers assisting them to potential product options based on how they answer a short, concise questionnaire. It then provides the user with a seamless experience to apply online or research further.

Busy online customers who want to learn about and choose financial products need to easily understand product options to find what will work best for their needs, especially when there are too many products with only subtle differences to choose from.

Although the long-term solution was to reduce and simplify the product offerings, the first stage was to create a question/answer tool that would quickly narrow down the options for the customer based on their specific circumstances and need.

This gave not only online customers a more guided alternative to the existing comparison tool, but bankers would also be using the tool to maintain perfect standardization in helping the in branch customers make the same product decisions.

The customer was able to easily know what product they like best based on clear, concise information that will allow them to make an informed choice. After the 1st 6 months:

- Over 95% engagement

- Only 6% users used alternate Compare All Accounts

- %7.5 Increase in application start rate from previous year