View my LinkedIn profile and learn more about my network.

https://www.linkedin.com/in/vickypeterson/

Guided Digital Account Setup

UX Product Design Lead

What I did:

- Managed the design strategies and was design lead for 3 Scrum teams simultaneously

- Worked directly with several product partners to continue to develop and modify epics, features and strategies to effectively connecting user needs with business goals throughout all the planned MVPs

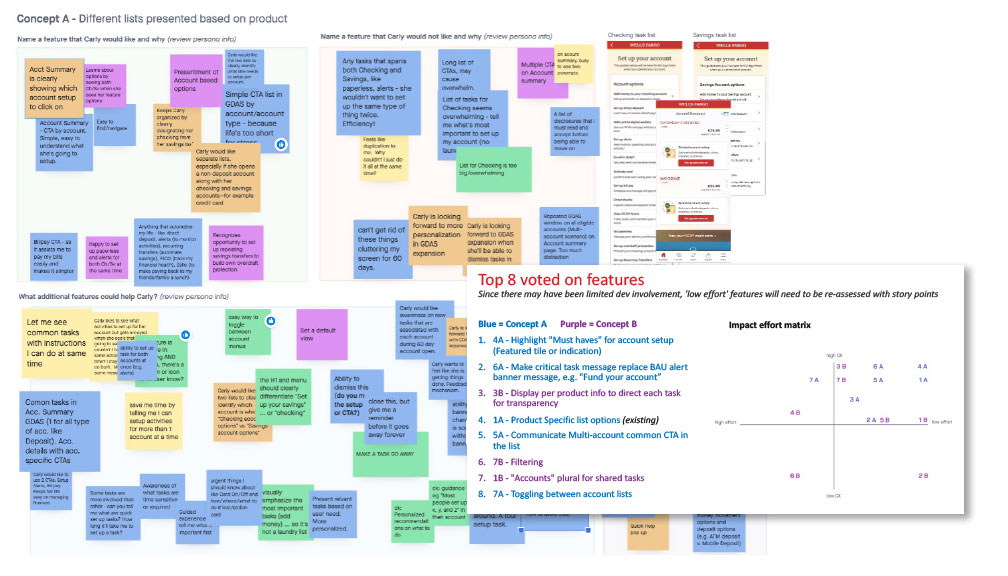

- Developed and lead remote design thinking workshops with the project partners to align concepts and strategies to better focus the business goals and understand the customer

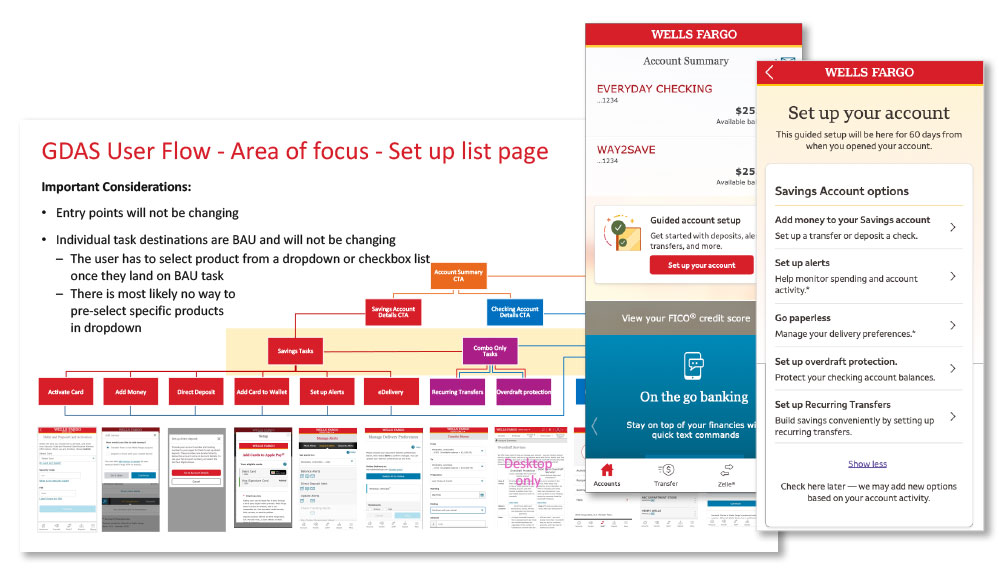

- Presented those experience strategies as wireframes and user flow visuals for partner discussions and to clearly direct the rest of the design team deliverables

- Lead design team on parallel tracks, quickly creating required designs, strategies and deliverables for the immediate MVP scrum requirements, along with producing design concepts and initiatives for the future iterations incorporating the previous discovery ideas and user testing findings

- Created prototypes and managed user testing direction, timing and feedback ensuring it would be effectively incorporated into the designs and future work

This is a Consumer Checking, on-boarding experience that guides new customers through their initial online banking experience, pointing them through the complex options available and making sure that they can find and complete the most immediate tasks that a new customer would need to accomplish and understand.

The online banking experience is overly complex due to many options and technical constraints combining the service functions together. It was never a good customer experience and many new customers, finding themselves without the ability to navigate the system, end up not finishing the required tasks and give up. After 60 days without funding or use, their accounts then get closed.

Although there was no way to rebuild the back-end functionality to give the customer a better experience, it was possible to determine the essential tasks and build a small hub to direct the new customer to those specific items.

This gave online customers a more guided alternative to the necessary tasks in order to start using their account. It also gave them a feeling of being directly cared for and even given personalized guidance, specific to their combination of accounts. Bankers, introducing new customers to their account would also benefit by having a consistent and simplified hub through which to guide them.

The customer was able to easily know what task they needed to complete based on clear, concise information that allowed them to understand their new online experience and feel comfortable managing their account. After the 1st 2 months:

- Online account funding increased by 7%, exceeding the expected 5% target

- Users digitally active after 60 days also increased by at least its 5% target